japan corporate tax rate 2020

The maximum rate was 524 and minimum was 3062. As a result the effective tax rate for the highest bracket was 45945 for 2020.

Malta Corporate Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical Chart

Japan corporate tax rate kpmg.

. Dividends interest and royalties earned by non-resident individuals andor foreign corporations are subject to a 20 national WHT under Japanese domestic tax laws in principle. Income from 0 to 1950000. Tax rates Before 1-10-2019.

Offices or factories located in up to two prefectures. Income from 9000001 to 18000000. Corporate tax amount is 10 million yen or less per annum and taxable income is 25 million yen or less per annum.

Non-incorporated association and foundation are deemed as corporation for tax purposes then required to file tax returns for each fiscal year as same to a company if they are engaged in continuous profit-making business Corporation Tax Law hereinafter referred to as CTL Article 4 Para 1. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020.

The 2020 Tax Reform Act provides for tax measures to promote investment in. However the final corporate tax rate has not been announced but the change will be effective progressively from next year. Moreover the annual amount of up to JPY8 million in income eligible for the reduced tax rates applicable to SMEs will be distributed.

If the tax return is filed late a late filing penalty is imposed at 15 to 20 of the tax balance due. Japans Prime Minister announced on 24 th June 2014 that the government will lower Japans corporate tax rate from 35 to below 30. On and after 1-10-2019 JPY 100 mln.

Income from 1950001 to 3300000. Under the 2020 Tax Reform Act the interest rate applied by tax offices on delinquency tax and on refunds paid to taxpayers will be reduced from the current 16 per annum to 11 per annum. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

Taxation in Japan 2020. Tax rates The tax rates applied to profit and loss sharing groups will be the respective tax rates applied to each individual entity in accordance with its corporate classification. Tax rates for corporate income tax including historic rates and domestic withholding tax for more than 170 countries worldwide.

The United States has the 85 th highest corporate tax rate with a combined statutory rate of 2577 percent. Local inhabitant tax consists of prefectural tax a flat rate of 4 plus 1500 of per capita levy and municipal tax a flat rate of 6 plus 3500 of per capita levy. Income from 3300001 to 6950000.

Share with your friends. 41 rows Corporate Tax Rate in Japan remained unchanged at 3062 in 2021. Taxable income x Standard rate of business tax-37.

Corporate Tax Rate in Japan averaged 4083 percent from. Measures to transition from the current consolidated tax regime will be introduced. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of 3062 percent in 2019.

The surtax rate of 21 is applied to the amount of national income tax. Under the 2020 Tax Reform Act the currently effective consolidated tax regime would be abolished and replaced with a new regime of group relief group tax relief. On 27 March 2020 the 2020 Tax Reform Act was approved by the Diet and on 31 March 2020 the 2020 Tax Reform Act the Enforcement Orders and Regulations were promulgated which are effective for corporate tax years beginning on or after 1 April 2020 in principle.

Interest on loans however is taxed at a 20 rate. The new regime will be effective for tax years beginning on or after 1 April 2022. In Japan the Corporate Income tax rate refers to the highest corporate tax rate for companies with taxable income above 8 million JPY a year based in Tokyo.

KPMG Tax Corporation Izumi Garden Tower 1-6-1 Roppongi Minato-ku Tokyo 106-6012 Japan Tel. 225 rows One hundred of the 223 separate jurisdictions surveyed for the year 2020 have corporate tax rates below 25 percent and 117 have tax rates above 20 and at or below 30 percent. Japan Income Tax Tables in 2020.

An exceptional rate of 15 is applied to interest on bank deposits and certain designated financial instruments. India Russia Coop In 6g Cybersecurity And Video Analytics Gathers Momentum Cyber Security. Corporate and international tax proposals in tax reform package 19 December 2018.

Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. The Government targets to return to a principal fiscal balance in 2020. Taxable income x Standard rate of business tax-260 JPY 100 mln.

The average tax rate among the 223 jurisdictions is 2257 percent. Income from 6950001 to 9000000.

Taxing Corporations Might Be Good Politics But It S Still Bad Policy Cato Institute

Global Minimum Tax What Is It How Would It Work For Multinational Companies Bloomberg

Corporate Tax Reform In The Wake Of The Pandemic Itep

Israel Corporate Tax Rate 2022 Data 2023 Forecast 2000 2021 Historical Chart

Real Estate Related Taxes And Fees In Japan

Corporation Tax Europe 2021 Statista

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

International Corporate Tax Reform Dgap

Individual Income Tax Return Filing In Japan For Foreigners Latest 2021 2022 Shimada Associates

Liechtenstein Sales Tax Rate Vat 2022 Data 2023 Forecast 2006 2021 Historical

Real Estate Related Taxes And Fees In Japan

日本 企业所得税税率 1993 2021 数据 2022 2024 预测

Doing Business In The United States Federal Tax Issues Pwc

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Real Estate Related Taxes And Fees In Japan

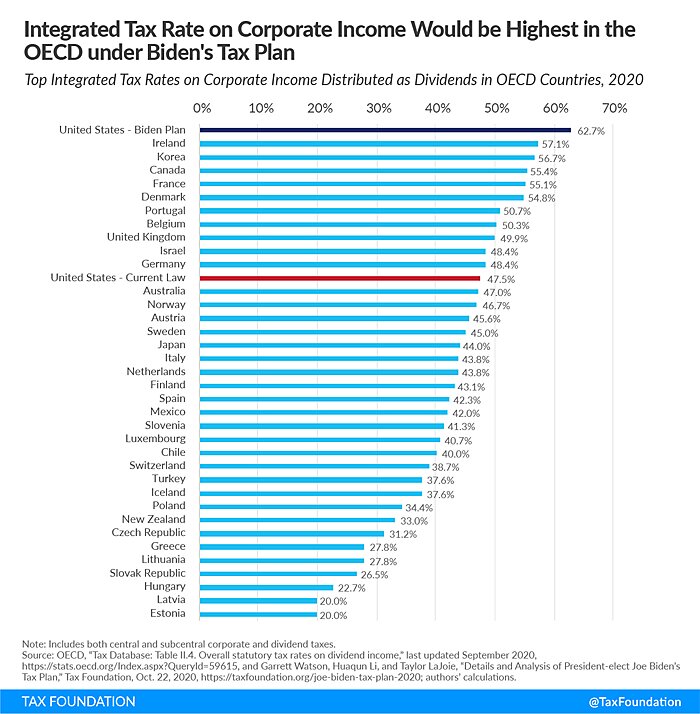

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget